Thursday December 7, 2017

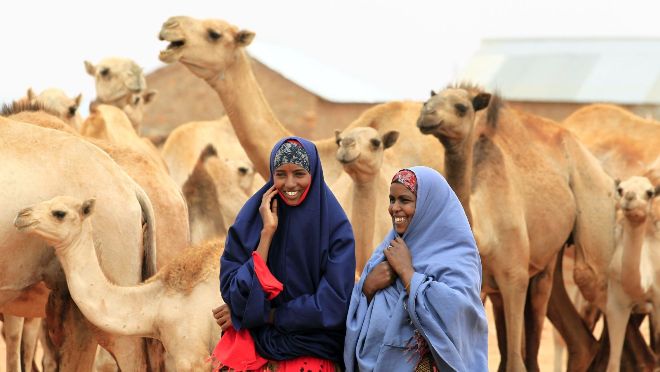

Somalia is a global leader in the export of goats and sheep, and livestock trade generates about 40% of the country’s gross domestic product.

Yet almost every other year, recurring droughts and water scarcity take a toll on local pastoralists’ ability to keep their animals live and healthy.

In 2017 alone, livestock loss has ranged from 20%-40% in the southern regions and 40%-60% in the north, according to the Food and Agriculture Organization. This threatens the livelihood of the animal farmers and hinders their ability to regularly trade in markets.

But a Sweden-based startup wants to change this by creating a tech-powered livestock market that is open all year round. The goal of Ari.Farm (“Ari” means “goat” in Somali) is to get investors to purchase livestock from locals, injecting much-needed cash into the market and potentially making a profit.

Once a purchase is made, an investor is able to name his animals, follow their progress online, and even gift or donate them. Ari.Farm takes care of the animals in two farms, one located outside Galkayo town in south-central Somalia and the other outside the capital Mogadishu.

As the number of animals one owns grow from breeding, they can decide to sell them at the local market price. That amount could then be used to re-invest in more livestock or be withdrawn by the financier.

Ari.Farm founder Mohamed Jimale, a former nomad himself, says since beginning operations in 2016, people from 26 countries across the world have bought almost 1,000 goats, sheep, and camels through Ari.Farm.

“The Somali livestock owners are not poor, they have wealth,” Jimale told Quartz. But if they are to survive “they need to find a market for their livestock.”

Across Africa, Ari.Farm is hardly the only start-up committed to crowdfarming as an avenue for investment, tackling unemployment, increasing social impact, and unlocking multi-million-dollar markets. Livestock Wealth in South Africa, Mifugo Trade in Kenya, and AniTrack in Ghana are but some of the applications bringing livestock trade into the digital economy.

In Nigeria, agro-tech start-ups like FarmCrowdy and ThriveAgric have also enabled middle-class Nigerians to fund existing farms for between $200 and $750 for a harvest cycle.

Ari.Farm has now gone a step further and introduced cryptocurrencies as a payment method. Jimale says this was necessitated because customers and financial institutions kept asking about the risks of investing in Somalia. For decades, Somalia has had a freewheeling economy with the majority of the currency in circulation considered fake.

But as the price gain for Bitcoin surges past $11,000 and also gains ground in the developing world, Jimale says it allows them to attract more customers and sidestep some of the conventional central banking requirements.

So far, about 10% of Ari.Farm’s transactions are traded through bitcoin, and the company hopes to integrate Blockchain technology for a trading platform in the future. Part of that might come as Ari.Farm looks to close seed funding of up to 2 million Swedish Krona ($237,000) in the coming months.